Buy Now. Pay Later. Your Terms. Your Way.

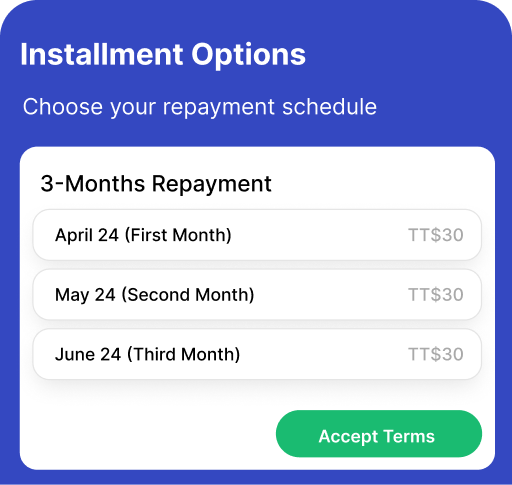

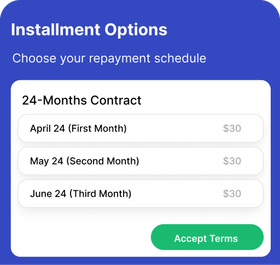

With CrediQ, you have the freedom to pay over time—allowing you to get what you need today and select a payment plan that suits your lifestyle. Choose from flexible payment options spanning 6 to 36 months, so you can find the plan that best aligns with your budget and financial goals.

Why Choose US?

There’s a world to discover with our great features.

No Hidden Fees

Fast Approvals

Low Monthly Payments

Trusted Retail Partners

Secure & Transparent

Pay in 3 Installments

Smart Money Tips

Your Questions Answered

Frequently Asked Questions

Get what you need today, pay in easy parts. No hassle, no stress.

What is Buy Now, Pay Later (BNPL)?

BNPL is a flexible payment option that allows you to purchase items now and pay for them over time through scheduled instalments. It's a simple and convenient way to access higher priced items without paying the full price all at once. It allows you to have the item immediately and make small manageable payments tailored to suit your budget.

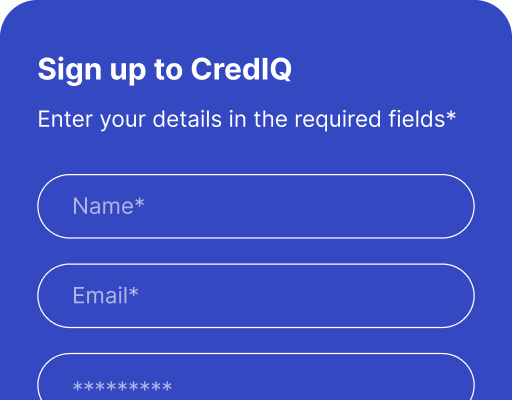

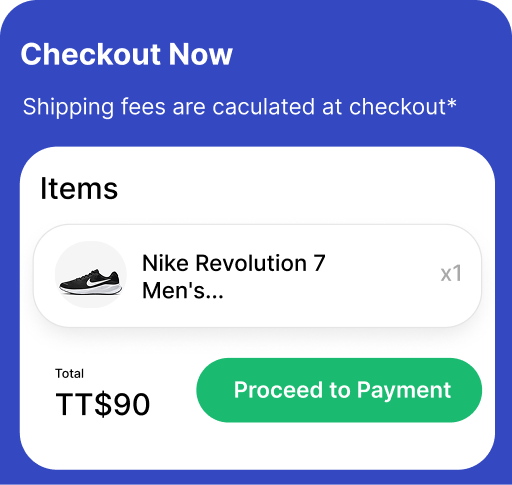

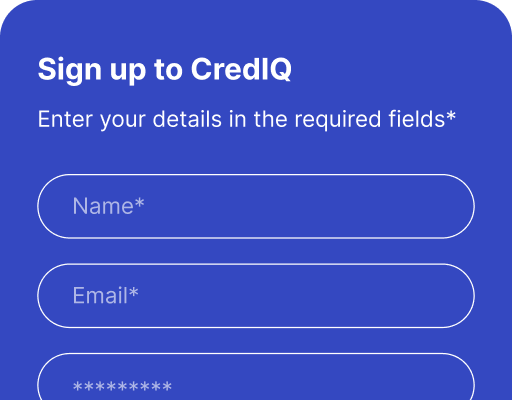

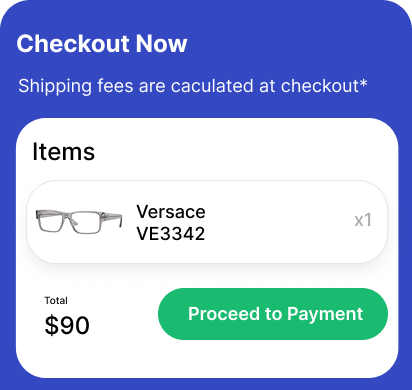

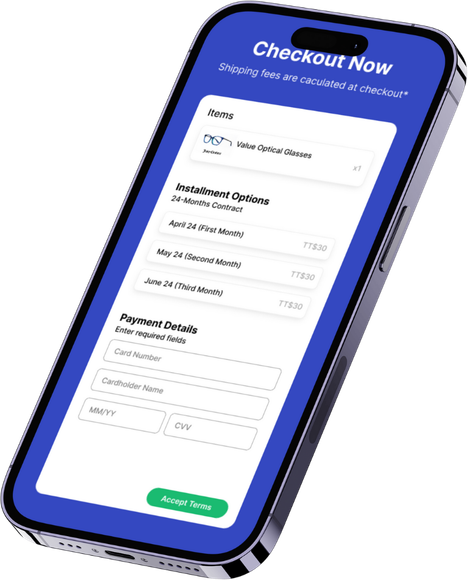

How does CrediQ's BNPL service work?

CrediQ is an affordable way to purchase items at your preferred partners. We provide those products to you through easy payment options. When shopping with our partner merchants, select CrediQ at checkout. You will complete a quick application and once you are approved, you will be automatically notified. This usually happens within 48 hours. The merchant is notified as well and will proceed to finalise your sale and delivery.

Do I need good credit to apply?

Not necessarily. We consider more than your credit score. And we know people's circumstances can change. We believe in second chances. Share your current data with us and we will get back to you.

Are there any hidden fees?

CrediQ payment plans include the value of your purchase and service charges. The monthly payment is a function of the purchase value, service charges and the length of time over which you wish to repay the total amount. There are no hidden fees in your instalments.

Will applying for CrediQ affect my credit score?

Purchase through CrediQ involves a soft credit check, which does not impact your credit score. In fact, applying for credit and repaying your instalments on time may actually improve your credit rating making it easy for you to access credit nationwide.

What types of products can I purchase using CrediQ?

CrediQ can be used for a variety of products, including eye wear, home goods, electronics, furniture, and hardware items. Our goal is to make essential purchases more accessible to you.

How do I make payments?

CrediQ plans to have multiple payment options: for eye wear purchases you can pay at your Value Optical branch, and will soon be able to pay online through your dedicated portal access. All CrediQ customers have access to their portal where they can see their outstanding balance, payment history and make their instalments without leaving the comfort of their homes.

Can I pay off my balance early?

Yes you can. We understand that people's circumstances change and at CrediQ our goal is to make it as convenient as possible for our customers who we hope to become lifestyle partners.

What happens if I miss a payment?

We recommend contacting our support team immediately to discuss your options and avoid further penalties.